Research & Develop Independently, Catch up from the Behind, Domestic ATM Develops Quickly - Analysis on Domestic ATM Market in 2015

- 2016-05-19 Browse:2145

In 2015, the market of domestic cash type financial self-service equipment developed vigorously along with the innovation and upgrading of financial industry, showing a steady operation trend on a whole scale. As market competition became increasingly fierce, the structural demand of mainstream products in the industry changes gradually, localization and intelligent trend became more and more obvious, and industrial structure is further adjusted and optimized. Various kinds of new self-service equipment emerged continuously, and they brought new service experience to customers while improving service efficiency.

Quick growth of total quantity and intensified purchase pattern variation

According to the Overall Payment System Operation of 2015 released by PBOC, there were totally 866,700 networked ATMs countrywide, increasing by 251,800 sets at a rate of 40.95%, comparing with 614,900 sets at the end of last year. According to statistics, financial institutions, including state-owned banks, joint-stock banks, urban commercial banks and rural commercial banks and rural credit cooperatives bought about 121,000 ATMs in 2015, increasing by 24.49% comparing with 97,200 sets in 2014, and hitting the record high by exceeding the purchasing quantity, 100,700 sets in 2012. The five banks, rural commercial banks and rural credit cooperatives and China Post (PSBC) are still the main purchasing power. The five banks, including ICBC, ABC, BOC, CCB and BOCOM purchased 33,700 sets more and their total purchasing quantity accounted for 27.9% of the total purchasing quantity, decreased obviously comparing with 46.85% in 2014 and 58.1% in 2013, while the purchasing shares of national rural credit cooperative system increased significantly. Overall Payment Business Development in Rural Areas of 2015 released by PBOC indicates that the number of ATMs grew quickly in rural areas in 2015, the using times per capita was high. By the end of 2015, there were 309,200 ATMs in rural areas, and the net increase of this year was 59,900 sets, increasing by 24.02%; the quantity per 10,000 people was 3.32 sets. The self-service equipment stocks of national joint-stock banks and urban commercial banks also increased significantly. Most of the self-service equipment are input into tier-2 or tier-3 cities and towns, expanding financial service scope and bringing great convenience to customers.

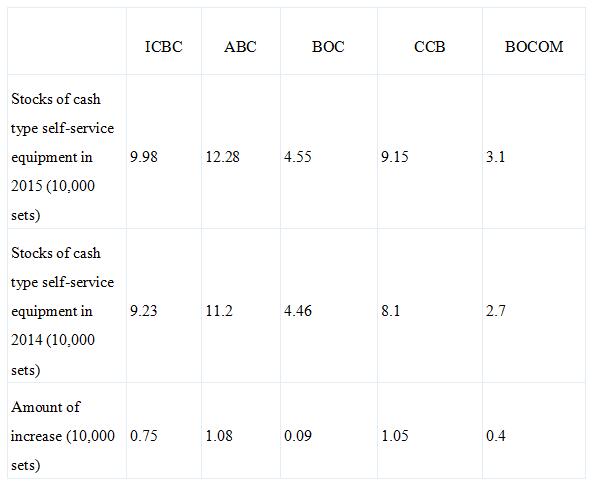

At present, the self-service equipment stocks of the 5 banks are basically as below:

* Above data is obtained from the annual reports of banks

In addition, there is still a big gap between the quantity of ATMs per 1 million people in our country and that of developed countries, according to relevant statistics. The quantity of ATMs per 1 million people in developed countries was 1,450 sets, while it was about 631 sets in our country at the end of 2015, according to the national economy operation data of 2015 released the latest by National Bureau of Statistics, showing a significant growth comparing with the quantity of about 452 sets in 2014. ATMs are mainly arranged inside bank or off bank in our country, and they are mainly arranged in developed areas, coastal areas and tier-1 cities. However, ATM is not widespread in the middle and western regions and many tier-2 and tier-3 cities; it is much less seen in counties or areas of lower levels.

According to the financial self-service equipment purchased by banks, tier-1 and tie-2 cities are arranging more and more CRSs, and ATMs that have no deposit function are off the batch procurement target of banks, and they account for only 20% of total purchasing amount. As for ATMs, most banks are moving those they previously arranged at tier-1 and tier-2 cities to tier-3 and tier-4 cities and counties, so as to reduce purchase cost and complete replacing ATMs in tier-1 and tier-2 cities with CRSs. Most banks will select more convenient and diversified ATMs, considering operation efficiency and service capability.

ATM sales of foreign brands decreases continuously and domestic ATM manufacturers become the main market force

In 2015, competition in domestic ATM market was fierce. On one hand, the demand for domestic traditional ATM products slowed down and the price war got fiercer and fiercer, as financial reform was constantly intensified and the innovation of financial service mode was deepened without stop. On the other hand, the shares owned by old Japanese and European and American manufacturers decreased continuously while the shares owned by domestic brands increased continuously. The domestic ATM industry enters the price competition stage led by domestic brands.

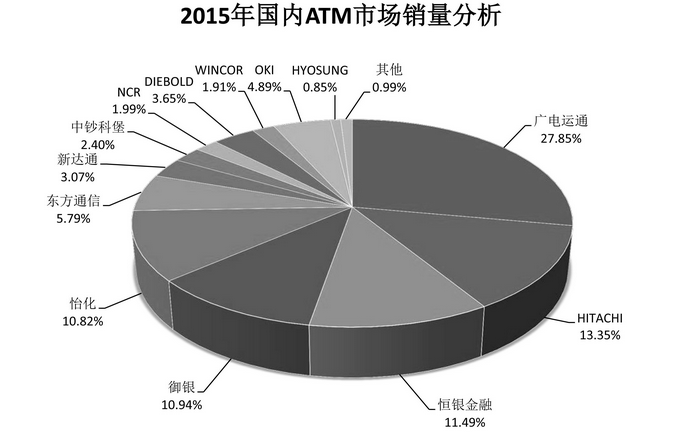

2015年国内ATM市场销量分析 | Sales Analysis on domestic ATM market of 2015 |

其他 | Others |

中钞科堡 | CBPM-KEBA |

新达通 | NDT |

东方通信 | Eastcom |

怡化 | OKI |

御银 | KingTeller |

恒银金融 | Cashway |

广电运通 | GRG Banking |

* Above data is from investigation authorities.

According to the industrial statistics of 2015, it can be found that domestic ATM manufacturers developed quickly, and 3 of them ranked among the top 5 best sellers, which were GRG Banking, Hitachi, Cashway, KingTeller and OKI. It can be seen from the ranking that Cashway and KingTeller developed quickly and their sales ratios increased obviously. In particular, Cashway emerged as the third in sales ranking. The sales and sales ratio of foreign ATM brands dropped greatly, showing a significant decline. In terms of the breakdown categories of ATM, CRS is at the mainstream status in market, its shares account for 72.17%. In 2015, the total sales of GRG Banking, Cashway and KingTeller was far more than the sales of Hitachi and OKI in China, and the sales of domestic brands occupied the marketing leading position for the first time. As domestic financial institutions have an increasingly demand for CRS, CRS is making a greater contribution to market share occupation of manufacturers. Domestic ATM manufacturers have taken the lead in market.

Independent, safe and controllable, domestic brands make substantial progress

Finance is the core of modern economy and safety is the top priority of financial industry. At present, finance is faced with more open operation environment, and therefore should be intensified to prevent network attack, virus invasion and illegal theft of fund. In September 2014, CBRC, NDRC, MOST and MIIT jointly released the Instructions on Strengthening Banking Network Safety and Informationization Construction with Safe and Controllable Information Technology, and put forward that the overall utilization of safe and controllable information technology in banking industry will be more than 75% in 2019. In December 2014, CBRC and MIIT jointly released the Guidance on Pushing forward the Application of Safe and Controllable Information Technology in Banking Industry (2014-2015) in December 2014, listing out safe and controllable information technology involved products, list of services and detailed technical requirements.

For a long time, the safety of financial industry is threatened by problems including the monopoly of foreign enterprises in core software and hardware in domestic financial field, weak risk control of financial business system; however, this situation is now being improved. Benefiting from inclusive financial system and the effect of national policies that encourage self-innovation and promote financial safety construction, the sales of financial self-service equipment of domestic brands further increases, welcoming a spring for industrial development. It can be seen from the statistical data that domestic national independent brands achieved the market pattern today relying on core technologies and their profound accumulation, which also laid a solid foundation for the development of domestic national independent brands and responding to the advocating of making Made In China “going global”.

Master core technology and take the initiative to localize ATM

Domestic ATM manufacturers that have mastered core technologies all keep inputting much in technical innovation and R & D, pursue international level core technologies, introduce investment from abroad and establish lateral ties at home, promote technical cooperation and master advanced and core technologies for CRS manufacture. For example, the R & D teams of GRG Banking and Cashway consist of doctors, masters and senior experts in the industry, forming tight combinations of production, education and research that have undertaken many national and ministerial level scientific research projects; the number of their patents is in leading position in the industry. “High-speed banknote recognition and processing technology” developed independently by GRG Banking has passed the authentication of MIIT; “large-capacity high-speed cash cycling module industrialization” project has passed the acceptance inspection of NDRC. Both of them have mastered core technologies and formed core competition. Machine cores independently developed by both of them have been used by many financial institutions, gained good market response and widely recognized for product maturity. It is believed that more and more domestic manufacturers will master the core technologies of financial self-service equipment, occupy more domestic market share sand walk into the international market in the near future.

Information safety in financial field is related to national property safety; effective guarantee of the information safety of public fields and social public relates to national safety, social stability and personal property safety. All domestic manufacturers should also master how to use domestic cipher algorithm and domestic operating system in financial self-service equipment

Cipher algorithm is one of the cores of safe and controllable information technology; it is important to apply algorithms, including SM2/SM3/SM4, in ATM, with the purpose of realizing the industrialization of safe financial self-service equipment. In order to promote safe and effective national cipher algorithm, related departments, such as NDRC, approved ICBC, Shanxi Rural Credit Cooperative and Hebi Bank to carry out online test of national cipher algorithm, and approved GRG Banking, Cashway and Eastcom to work as national cipher algorithm pilots. According to the situation of pilots, GRG Banking was shortlisted in the pilots of ICBC, Shanxi Rural Credit Cooperative and Hebi Bank; Cashway was shortlisted in the pilots of Shanxi Rural Credit Cooperative and Hebi Bank; Eastcom was shortlisted in the pilots of Hebi Bank, all of them gained good effects. National cipher algorithm has been promoted in domestic financial industry countrywide since 2015.

In the aspect of domestic operating system, GRG Banking and Cashway have reached strategic cooperation on the application of domestic operating system in ATM with National University of Defense Technology and Deepin respectively in succession to further strengthen the independence, safety and control of financial self-service equipment. At present, ATMs installed with domestic operating system can operate stably in postal system.

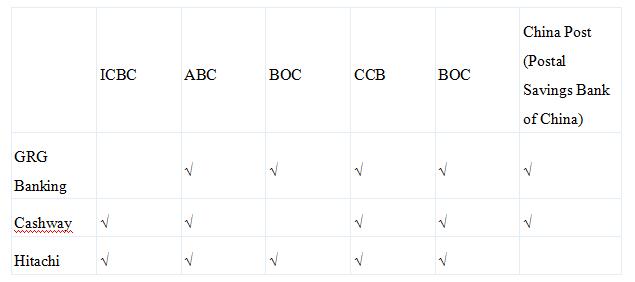

Self-service equipment of domestic brands promote the development of inclusive financial system

Under the powerful guidance of policies, domestic financial institutions made more use of financial self-service equipment of domestic brands. In the beginning of 2015, ICBC selected Cashway and KingTeller as its CRS suppliers after formal testing, marking that large banks started to use cash self-service equipment of domestic brands in batch. At present, 3 domestic manufacturers have been successfully shortlisted by 5 state-owned banks, and they are GRG Banking, Hitachi and Cashway. Domestic brands now own 2/3 of domestic market. See the table below for shortlisted manufacturers

In 2015, domestic ATM manufacturers continued making efforts in the market of rural financial institutions and urban commercial banks. It can be seen from annual reports and websites that GRG Banking had 129 subbranch clients more in 2015, including 57 rural banks; products of Cashway were shortlisted by 22 provincial level rural credit cooperatives and batch products were required; they also made excellent achievements in expanding to the market of urban commercial banks. The 2 companies, with the significant increase of their shares in the market of head office clients reserved, expanded their shares in the market of rural financial institutions and urban commercial banks. As the leader of domestic ATM operation and leasing, KingTeller kept an inertial sales growth in the market of rural credit cooperatives and urban commercial banks.

Under the situation of the great promotion of market demand and commercial institutions and the active R & D and promotion of manufacturers, it is expected that the market sales of independent, safe and controllable domestic CRSs will be further increased, making it the mainstream applications of the industry. In China’s financial self-service equipment industry, a market pattern of “GRG Banking in the south and Cashway in the north” has been formed by domestic brands that shoulder the task to localize financial self-service equipment in China jointly.

Mastering of core technologies is the source power for the development of domestic ATM manufacturers.

Affected by the “independent, safe and controllable” policy, the performance of foreign-invested ATM enterprises suffered a sudden turn for the worse, joint-venture manufacturers cooperating with foreign-invested ATM enterprises in OEM were also affected. Due to the unceasing performance decrease of foreign-invested ATM enterprises in China, Diebold and OKI reached strategic cooperation with Inspur and Digital China in ATM business respectively, with the aim to relieve the effect of purchasing policies by joint venture and cooperation, and integrate R & D, production and sales resource advantages through localization mode, such as technical cooperation, capital cooperation, in cooperation with domestic manufacturers lack of core technologies, so as to obtain more shares in Chinese market.

In the perspective of development, enterprises can only keep their continuous development by independent R & D, mastering of core technologies and constant strengthening of core competence, which has been proved by the sales change of domestic manufacturers in recent years. Manufacturers who have mastered the core technologies for financial self-service equipment will become the backbone in China’s financial self-service equipment field.